b&o tax states

Sales and excise taxes. Washingtons BO tax is calculated on the gross income from activities.

Washington State Sales Use And B O Tax Workshop

The Washington State BO tax is a gross receipts tax.

. You can find a list of cities that self-collect their Business and Occupation tax by clicking here. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. For example if you extract or manufacture goods for your own use you owe BO tax.

They then apply that rate to their gross receipts and cut Washington a check. Unlike the retail sales tax a sale does not have to occur for a business to owe BO tax. For all other types of business activities mainly retail a business has nexus if its physically present in the state.

Washington Bankers Association v. Some cities impose a BO tax that is not collected by the state of Washington. It is measured on the value of products gross proceeds of sale or gross income of the business.

And Germany did not protect the company from the BO tax. Heres how the state BO works. Most classifications come with a tax rate below 1 percent which is low.

The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT. The state BO tax is a gross receipts tax. BO also does not consider income or loss offers no deduction for cost of.

Business and Occupation Tax. But service businesses pay a 15 rate. This tax increase threatens to negatively impact.

Texas Franchise Tax The Texas Franchise Tax is a modified gross receipt tax imposed on most legal entity types conducting business in the state. Mechnically you simply pay a percentage of your gross receipts. Commonly the percentage runs about 5 or half a percent.

Extracting Timber Extracting for Hire Timber003424. So if youre in the service and sales category you owe 15 for every 1000 of income. Average state tax burden.

The BO offers very few deductions and those allowable are often within narrowly defined industry sectors. Washingtons BO tax is calculated on the gross income from activities. Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level.

Slaughtering Breaking and Processing Perishable Meat. TaxValet will not automatically handle local and city gross receipts taxes on your behalf unless specifically requested and agreed upon. For wholesalers and apportionable activities Washington defines nexus for BO tax purposes in RCW 8204067 1.

South Carolina charges all three major state tax types but does so in moderation. Washington unlike many other states does not have an income tax. Most Washington businesses fall under the 15 gross receipts tax rate.

A Washington State superior court granted summary judgment for banking associations holding that the states additional 12 business and occupation BO tax imposed on certain financial institutions violates the Commerce Clause of the US. How Does the BO Tax Work. Additional BO tax imposed on financial institutions.

253 591-5252 by contacting the Tacoma. The following chart gives the rates for each main category. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts.

Soybean Canola Processing. Washington unlike many other states does not have an income tax. At least twenty-five percent of the persons total property total payroll or total receipts in this state.

Further since the BO is not an income tax the Department held that the comprehensive tax treaty between the US. This means there are no deductions from the BO tax for labor materials taxes or other costs of doing. Manufacturing Wheat into Flour.

Manufacturing 07 Gross Amount Deductions Taxable Amount Rate Tax Due. InternetFax 11-10-16 Page January - December 2016 Retailing and Other Activities Return A 16 I. And thats an advantage that is often ignored.

32 rows B. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. However you may be entitled to the Multiple Activities Tax Credit MATC.

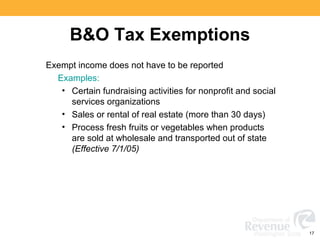

City of Tacoma Tax License Division 747 Market St Rm 212 Tacoma WA 98402. However your business may qualify for certain exemptions deductions or credits. And some businesses pay lower rates.

It is measured on the value of products gross proceeds of sale or gross income of the business. The Washington state business occupation tax works really simply. The BO tax for labor materials taxes or other costs of doing business.

Extracting Extracting for Hire00484. Businesses receive a classification with a corresponding tax rate. 2020 a 20 increase to Washington states business and occupation BO tax goes into effect increasing the tax burden on health care providers including independent physician practices.

Washington State BO tax is based on the gross income from business activities. Its sales and excise tax burden of 262 clocks in. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates ranging from 0138 percent to 15 percent.

Heres what the BO tax looks like for your business. B O tax rates When paying the B O tax to the Department of Revenue you declare your income in different categories. Constitution because it discriminates against out-of.

The Washington State Supreme Court today September 30 2021 upheld the constitutionality of the states business and occupation BO tax surcharge imposed on certain financial institutions. Read the high courts decision PDF 562 KB Background. State Business and Occupation BO Tax 1.

Double Duty How Startups And Small Businesses Could Be Hit Twice Under Seattle S New Income Tax Geekwire

9712 Fairbanks Morse H12 44 Baltimore And Ohio Railroad Train Photography Train

B O Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

Changes To Washington S B O Tax Economic Nexus Standard And Use Tax Notice And Reporting The Cpa Journal

50 First B O Passenger Diesel Painted For Abraham Lincoln Service On Subsidiary Chicago Alton Baltimore And Ohio Railroad Alton Train

Westward Movement Resource Box Gr 4 5 In 2021 Westward Movement Lakeshore Learning Social Studies Maps

B Amp O Tax Return City Of Bellevue

When Are Business Occupation B O Taxes Due

Business And Occupation B O Tax Washington State And City Of Bellingham

Why Our B O Tax Is Unfair R Seattlewa

Railpictures Net Photo Baltimore Ohio B O Coal Dock At Lorain Ohio By Doug Lilly Lorain Lorain Ohio Ohio

B Amp O Tax Guide City Of Bellevue

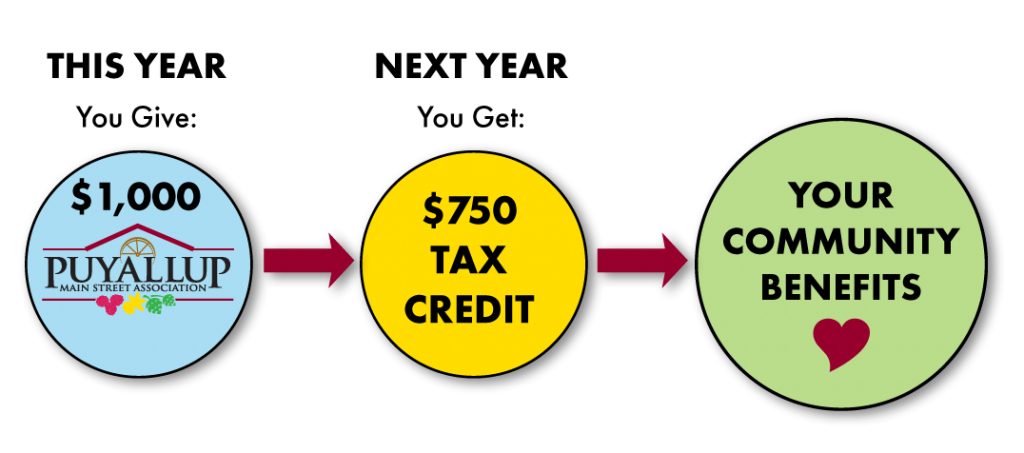

B O Tax Program Puyallup Main Street Association

Valley Of The Shadow Amazing Website All About Shenandoah Valley Before During After Civil War Unit Teaching American History High School History Teacher

B Amp O Tax City Of Bellingham

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus